Sales management and planning

Managing the sales function of a business, which may include managing a sales team, involves identifying your sales channels, deciding on sales strategies, setting sales targets and defining actions to achieve them.

Legal obligations

Legal and ethical selling meets the rights of customers and protects you and your business from the risk of fines, penalties, trading restrictions and other actions by regulators.

Before your business starts selling products and services consider:

- legal and ethical selling

- pricing laws and regulations from pricing products and services

- guarantees, warranties and refunds.

Calculate the revenue and profit needs of your business

Before you consider sales, take the time to review and understand your business's financial position.

Gross profit margin

Your gross profit margin helps you identify products making the most profit, so that you can focus your sales targets on them.

While any profit is good profit, some businesses concentrate on achieving higher sales targets for their more profitable items, rather than making 'broad' product sales with a thin margin.

Calculate gross profit margin

Break-even point

Calculate your break-even point by itemising all of your known, fixed annual costs (e.g. rent, electricity, insurance and wages), and then working out the volume of sales (in units) required to cover those costs.

Calculate break-even point

Minimum sales requirements

Your minimum sales requirements are how many of your products or services you need to sell to cover fixed costs, your salary and your desired profit. Keep in mind your aim is to achieve a fair return on the funds you have invested in the business, in addition to your salary.

There are a number of related costs involved in achieving your minimum sales requirements.

These include:

- marketing

- production

- administration

- labour

- supply costs.

Calculate minimum sales requirement

Return on investment (ROI)

Aim for a reasonable return on investment once you've calculated your break-even point.

Include what you consider to be a reasonable and a fair salary for the owner and/or manager of the business (i.e. you).

Calculate return on investment

Include sales in your business plan

Your business plan documents your objectives and the strategies and structures you have in place for achieving them. It should explain how you will manage important aspects of your business, including your sales strategies.

Our business plan template includes sections on:

- sales methods

- sales analysis and forecast

- HR section on sales employees and sales manager roles.

Find out more about writing a business plan.

Decide on your sales channels

Identify the sales channel, or combination of sales channels, that align with delivering your product or service effectively and meet the preferences and buying habits of your target customers.

Examples of sales channels include:

- direct consumer selling—market stalls, party planning, pop-up stalls in shopping centres

- direct B-2-B selling—selling in person, to buyers within other businesses

- over-the-counter retail sales—retail stores, take away food outlets, bottle shops

- online sales—ecommerce websites selling products

- telemarketing and telesales—calls to consumers to switch telco service providers, charity foundation donations

- reseller and distributor networks—other sales agents or businesses selling your products.

Learn more about choosing sales channels.

Creating sales strategies

A sales strategy is a plan, a tool or a tactic you or your sales team can use with the goal of improving sales. Strategies set out clear objectives and provide a guide for you or your sales team to follow. These strategies might focus on creating a sales pitch, reaching more customers or might simply be a demonstration of your product to each customer. Sales strategies guide the sales process and help teams to meet their targets.

A salesperson can make use of several strategies when pitching to customers, businesses or companies and each helps convince potential buyers to purchase what you're selling.

There are a range of strategies you can use, including how you will:

- keep existing customers (e.g. a customer rewards program)

- attract new customers (e.g. marketing and advertising)

- sell more to existing customers (e.g. up-sell).

Strategies help your salespeople reach realistic sales targets and are often based on your marketing strategy.

You can also help your sales staff achieve their targets by generating qualified leads and brand awareness from your marketing activities.

The AIDA sales model

Engaging customers and persuading them to buy requires skill and technique.

The AIDA model identifies 4 sales process steps:

- Attention—getting your customer's attention

- Interest—stimulating your customer's interest

- Desire—creating in your customer a desire for the product

- Action—leading your customer to take action and buy.

Some contemporary sales advocates have suggested variations to the original AIDA model to support today's online and highly competitive sales markets by adding a 'C' for conviction and an 'S' for satisfaction.

These variations recognise the importance of ensuring customers believe in the products that they are choosing and are satisfied with these products.

-

In today's multimedia sales environment, sellers need to grab customer attention fast.

- Appeal to your customer's emotions.

- Pose a challenging question.

- Use humour.

- Use a message that relates to current events.

- Use powerful, action-orientated words.

- Personalise communication directly to your customer—use 'you' and 'your'.

-

Today's customers are well-informed and cynical, and their time is precious. Holding their attention is your greatest challenge.

- Pitch the features of your product that set it apart.

- Show your customers your product's features and benefits.

- Make good eye contact when speaking to your customers in person. Also smile and focus solely on your customer.

- Start a conversation that helps you find ways to personalise your product and target it directly to your customer's needs. For example, share your experience of using the product.

-

Your customer needs to make a personal or emotional connection with your product in order to buy it.

- Make statements that appeal to your customer's needs and wants.

- Use empathetic language that identifies with your customer and tells them you understand.

- Personalise your statements with direct language (e.g. “You will find this invaluable”, rather than 'This is invaluable').

- Frame questions that appeal to your customer's emotion (e.g. “Would your mum enjoy this?”).

- Pitch your proposition as an 'opportunity' that will not return.

- Talk about the benefits, benefits, benefits—how the product will make them feel or improve their life.

-

Turning your customer's desire for your product into action is your final step to closing the sale.

- Offer an incentive to close the sale.

- Affirm your customer's decision to buy.

- Give your customer clear directions about what you want them to do such as visiting your website, filling in a form or making a phone call.

- Don't rush your customer once they've made their purchase—show them you're more interested in their satisfaction than the sale.

- Give your customer a reason to return after you've closed the sale, such as wanting to buy another related product.

-

This extension of the original AIDA model suggests that consumers are becoming sceptical to marketing claims and are now seeking evidence to support these claims.

- Use hard data to support any marketing claims.

- If you don't have access to data, try to build some. This can be achieved by market-led research (e.g. customer surveys) or through third party verification.

- Monitor social media comments and ensure you action them to maintain positive reputation.

-

This extension of the original AIDA model means that the sale doesn't just stop on purchase.

Did your customer enjoy the purchase and the purchase experience or not?

The experience of your customer presents an important stage for monitoring sales success in addition to generating positive potential word-of-mouth and social media.

The AIDA technique is not solely used for sales. The technique can also be used in your advertising and marketing campaigns.

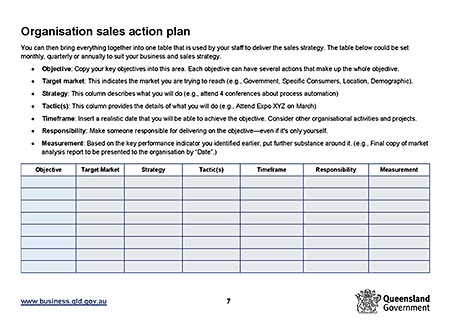

Creating a sales plan

A sales plan defines the business's sales targets to ensure strong turnover and healthy profits. It also helps you define your goals including how much of each of your products, services or experiences you need to sell and how you will achieve these sales.

Inclusions in the sales plan

Include customers' expectations and buying trends in the sales plan you develop for your business.

Focus on the sales process and set targets for your sales team. It is important to then measure your team's performance against these targets to ensure your business stays profitable.

Share business sales objectives with your team. Many business owners are reluctant to share them. If your staff don't understand what you expect them to work towards, it can be difficult for them to understand the specific goals you want to achieve.

Business goals you want to achieve could include:

- achieving lead advantage or being a recognised specialist

- maintaining your market share

- achieving a specific sales revenue target

- opening a number of 'shops' in new locations within your geographic area

- expanding into wider geographical locations and markets

- diversifying your product or service range.

Next, detail the steps you plan to take to achieve each objective.

Examples of these steps might include:

- providing specific training to your staff to ensure they have the skills and product knowledge required

- hiring a salesperson with experience in the target market or the particular geographic area you wish to focus on

- setting out how many contacts your sales team should make in a target area in any particular day or week—for example, the number of calls, emails or personal visits they should make. It is recommended you have your sales team document or record what they have achieved against the targets you set.

Your sales plan should end by explaining how you will measure the success of your efforts, not just in terms of an increase in total sales, but also, for example, through an increased conversion rate of calls and visits to sales.

Action: Download the sales plan template

A sales plan defines the business's sales targets to ensure strong turnover and healthy profits.

Use the sales plan to define your goals including how much of each of your products, services or experiences you need to sell and how you will achieve these sales.

Record your sales targets in your sales plan.

The difference between sales forecasts and sales targets

A sales forecast is a prediction of the sales you expect to achieve over an extended period (e.g. monthly, quarterly, annually). Sales forecasts can make use of your sales history or market research to underpin each forecast. Forecasts can be listed by product or product line and market segment.

It is important to make realistic forecasts.

Include:

- how many new customers you gain each year

- how many customers you lose each year

- what your average volume of sales is to each customer

- particular months where you win or lose more customers than usual

- how many products you sell per year or per month

- how many sales you make to each market segment per year or per month

- how many sales per month you expect to achieve by product or product line

- how many sales per month you expect to achieve by market segment.

Record your sales forecasts in your business plan.

A sales target is the number of products to sell in a given period to break even or make a profit. These targets should meet the forecasts of your business plan.

Sales teams thrive on well-defined sales targets which are clearly defined during training sessions and in your sales plan.

Sales targets allow you and your sales staff to:

- set clear goals

- pursue incentives and bonuses that motivate and reward

- keep measuring, challenging and improving your sales performance.

Reliable sales targets track your sales progress within each period and adjust your sales goals to meet your market and business needs. You can set targets by market segment, by region and for each member of your sales team.

Your sales targets form part of your sales plan and are used to achieve the financial performance goals for your business to generate profits and ensure long term sustainability of your business.

Types of sales targets

Specific and realistic sales targets help your sales team perform confidently, consistently and with a clear understanding of your expectations.

Choosing the right type of targets—and involving your team in choosing these targets—can help you achieve your sales goals and grow your profits.

Sales targets by product

Setting specific goals for each product or group of products is a simple and effective way to meet your monthly sales budget.

Product sales targets usually list the number of products you need to sell, as well as the targeted average sale price you need to get, to achieve a budgeted profit.

Sales targets set by product also include other important business information, such as stock and storage requirements.

Sales targets by market segment or customer type

Businesses that target their markets clearly and accurately are more likely to achieve good sales figures.

The 80:20 rule is an important rule for sales planning. Also known as the 'Pareto principle', it means you will generally make 80% of your profits from 20% of your customers. Studying your market and identifying the profitable 20% will help you target and achieve successful sales.

Market segmentation—or dividing your market—is a good place to start in setting effective sales targets. However, setting sales targets by market segment can be quite challenging.

Segmenting your market means grouping together customers with similar needs and characteristics, and customers who respond in similar ways to your products or services. For example, a hardware store might group its customers into 2 segments:

- home handymen and DIY customers

- building industry professionals.

Customer researchers often choose to group market segments by:

- geographics (region of the world, country, state or territory)

- demographics (age, gender, family size, income, occupation, education, socio-economic status, religion, nationality)

- psychographics (personality, lifestyle, values, attitudes).

Using your marketing plan as a guide will help you to achieve your sales targets by pitching your products and services to these characteristics of your market segments.

Sales targets by region or store

Businesses with area or travelling sales representatives most commonly set sales targets by region—removing the difficulty and frustration of setting and monitoring individual targets for large numbers of products.

These businesses find it easier to set a dollar figure target per region, covering the whole product range and all the customers in that region.

Regional targets are 'big picture' targets. Because they cover large customer numbers and don't specify product sales, you need to keep them simple—one figure per area.

Setting product sales targets

Your sales targets need to increase as your business grows. Good sales planners set targets in areas that will drive business growth. For example, if the market is chasing compression gym clothing, gym wear retailers increase their targets for that range.

In setting sales targets:

- consider the profit margins each of your sales will achieve (there's little point reaching your sales target figure but shrinking your margin to achieve it)

- be realistic—your targets must be supported by your marketing plan

- keep all your business costs in mind and plan for growth

- consider selling slow moving products for a lower margin.

Managing a sales team

Setting sales targets helps you measure how effective each member of your sales team is. They reveal your opportunities to develop and reward your team and keep them improving. Setting unrealistic targets can have a negative impact on your business in several ways, including demotivating your sales staff.

When setting targets for your team, ensure they have adequate training and product knowledge to achieve the targets you set.

Involve your sales team

Your sales staff often know your product well and understand how it performs in your market. Involve them in gathering information, reviewing sales and setting sales goals.

Bring your team together to consider these questions.

- Who currently buys this product?

- How many do they buy per year?

- Which customers are most likely to keep buying from you?

- Which customers are most likely to increase their orders and how can you persuade them to buy more?

- Which customers do you think will decrease their orders and why?

- Are there any customers you might lose and why?

- How many new customers do you need in order to maintain existing sales and reach your sales target?

- What are your sales patterns throughout the year? Are they seasonal or related to a business cycle?

The more involvement your team has in setting sales targets, the keener they'll be to reach them.

Develop your sales team

Use your sales target reviews to identify staff training, development and mentoring needs.

Ask each staff member what additional training they believe will improve their selling skills.

Motivate your sales team

To encourage your team to meet their targets, consider offering incentives such as movie passes, theatre tickets or end-of-month bonuses.

Give your staff specific targets

When you're setting sales targets, consider your sales plan and setting specific targets for your sales team.

Specify targets by customer. For example:

- new customers—identifying targets for customers you'll bring in who have never bought from you before

- existing customers—identifying targets for product or service enhancements you'll sell (up-sell) to your existing customers

- past customers—identifying targets you'll set to encourage past customers to return.

Specify targets by activity. While these may not lead directly to sales, it can give you an idea of how your staff perform.

For example:

- new contacts—shows you how effective your sales team is in making new contacts with people who could become customers

- leads generated—shows you how effective your sales team is in generating interest from new potential customers

- new leads converted—shows you how effective your sales team is in converting potential customers into customers

- customer contacts—shows you how effective your sales team is in maintaining and building interactions with your existing customers.

Indicate the number of phone calls and face-to-face meetings your sales team should make each day or week to meet their targets.

Provide them with a tool such as a spreadsheet or access to the customer relationship management (CRM) system to record the calls and meetings they undertake.

By setting targets, you can measure performance, assess strengths and areas for development.

Also consider...

- Explore business finance essentials.

- Find help to improve your sales skills in offering add-on sales.

- Learn more about managing revenue and sales.

- Find tips and advice on sales promotions and discounts.