Closing a business

Whatever your reason for closing your business, there are many considerations you have to address before 'closing the doors'. There's also a lot you can do to make the process less stressful and get better outcomes.

Alternatives to closing your business

If you'd prefer to continue operating your business, read more about alternatives to selling or closing your business.

Make mental wellbeing a priority

Closing down your business is not just about meeting the practical and legal requirements. It can be a confronting experience for you, your family and your employees. Some small business owners may even feel they're disappointing their customers and community.

-

As the business owner, you'll have to:

- deal with your feelings about leaving everything you've built up, as well as your staff's concerns and uncertainties

- juggle the workload and pressures of still operating the business, while preparing it for closure.

To do this, try to give yourself the benefit of a strong support network:

- a business adviser (a lawyer, accountant or financial counsellor)

- your friends and family

- mental health support services (see below).

Also try to:

- get a clear understanding of the reasons you're closing your business

- have a well-defined idea of what you'll do after you've closed the business.

-

As an employer, you need to monitor and provide support to your employees during this stressful time. Be aware of any possible health and wellbeing issues they might experience because of:

- job insecurity

- transitioning through the sale of the business

- change in owners.

You can:

- provide them with contact details for counselling services (see below)

- read about how to manage people through change

- learn more about communicating effectively for business.

Find support

- There are a number of free mental health and wellbeing resources for businesses.

- The small business wellness coaches can help with your unique and personal business challenges, needs and opportunities in a free one-on-one, supportive environment.

- Lifeline offers confidential emotional and crisis support. You can speak to a trained and dedicated volunteer 24 hours a day by phoning 13 11 14.

- Beyond Blue can support those experiencing depression and anxiety.

Voluntarily closing a business

There are broadly 2 situations in which you would voluntarily close your business.

You no longer want to run the business

You may have decided, for example, to retire, that running a small business is too stressful, or that it's not the right business for you. You also:

- don't want to, or can't, sell the business

- have no-one to take it over.

You're likely to have time to plan your closure. This will help you to:

- close efficiently

- meet your legal obligations

- save money

- take away maximum profits.

Your business isn't doing well

You might be closing your business because:

- it's not covering its overheads and operating costs

- you can't sustain the operating costs while trying to sell it.

Your best option might be to sell some or all of your business assets, pay off your debts and keep whatever remains.

This may prevent you from becoming insolvent or bankrupt, and help you to leave the business without any long-lasting impacts.

Find help to manage your debt

- Consider the free financial counselling for small business owners funded by the government.

- Learn more about surviving an economic downturn.

- Find out how to manage your cash flow.

- Read the help when you're in debt guide from the Australian Competition and Consumer Commission.

- Access free advice during and after business hours as well as free tools and resources from the National Debt Helpline.

- Find out about simplified debt restructuring for eligible small businesses.

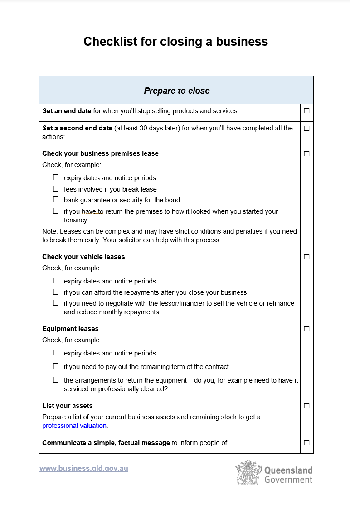

Closing-down checklist

There are many things you need to address before closing your business. It's important to have an exit strategy. Your accountant, solicitor or business adviser will be able to help you with this.

Our closing-down checklist (DOCX, 115KB) can also provide you with direction during this difficult period. It gives a:

- timeline for completing activities

- list of legal requirements and other considerations.

Legal and financial obligations when closing a business

Depending on your legal structure, all or some of the following points might apply to you when you voluntarily close your business.

Talk to advisers

Talk to your accountant, solicitor and business adviser about legal requirements for closing your business. It is important to pay for these services to ensure you do it correctly and with the minimum number of negative consequences as possible.

Free services provided by financial counsellors can also assist you in this process.

-

You must cancel your business name with the Australian Securities and Investments Commission (ASIC) within 28 days of closing down.

-

Notify your staff

You must give your staff notice if you're ending their employment. If you notify them while your business is still trading, you must continue to look after their health and safety in the workplace. This includes their mental wellbeing. When you let them know that their employment will be terminated, also give them information about, and contact details, for counselling support services.

Check staff entitlements

Permanent employees will usually be owed entitlements. Bookkeeping software will:

- show the amount owing to each employee

- calculate entitlements owed until the employment end date.

These entitlements could include accrued annual leave or long-service leave. Check employment contracts to ensure you're paying the required notice stated in their legal agreements.

Finalise employee tax-related matters

You must finalise all tax issues for your business, even if it's no longer trading. This includes your obligations regarding payment of:

- fringe benefits tax

- pay-as-you-go (PAYG)

- superannuation

- employment termination.

Learn more about these obligations to employees.

Cancel workers' compensation accident insurance

You'll also need to cancel your workers' compensation policy by following instructions on page 4 of the WorkCover understanding your workers' compensation accident insurance policy (PDF, 828KB).

-

There are tax deadlines and obligations you must meet. For example:

- if your business is registered for GST you have to apply to cancel GST registration within 21 days of ceasing business

- if you have an Australian Business Number (ABN), you'll need to notify the ATO within 28 days of ceasing business.

Before you cancel your ABN

Before you cancel your ABN, you must:

- lodge all activity statements

- meet your PAYG withholding obligations

- ensure you meet your tax liability.

-

If your industry or business requires you to have professional indemnity insurance, you'll still need to keep a policy (called run-off cover) after you close your business. Because your liability does not cease when the business closes, run-off cover is designed to protect you from future litigation.

Deregistering or winding up a solvent company

There are 2 ways to close your company if it's not insolvent:

- You can apply to ASIC to voluntarily deregister your company. Your company must first meet certain legal requirements.

- Shareholders and directors of the company may decide to voluntarily wind up the company.

Consider talking to a business adviser to determine which option is appropriate for your company.

Learn more about deregistering or winding up a solvent company.

Dissolving a partnership

Partnership agreements are legally binding contracts that set out the rules for a business operating under this type of business structure. Partnership agreements usually specify:

- conditions under which the partnership will be terminated

- how assets will be distributed among partners.

Many small business owners don't develop formal documented partnership agreements when they start a business together. This can make it difficult to agree on what each party is entitled to when the partnership is terminated.

Get legal advice before winding up a partnership.

Insolvency and bankruptcy

Insolvency occurs when your business cannot pay its debts, which can result in your business closing down.

Different insolvency procedures apply to individuals and companies.

Seek expert advice if you're considering bankruptcy or insolvency. There are serious consequences that can have an impact on your life for many years.

-

Working your way through insolvency or bankruptcy can be one of the most stressful experiences of your life. If you try to deal with it yourself, you'll need to communicate with every creditor individually to try to negotiate regular payment amounts.

Insolvency or bankruptcy advisers can:

- support you through the process

- help you understand your options

- negotiate with your creditors on your behalf.

They hold specific licences and qualifications in this specialised field. Their fees can be high and they usually require a lump sum payment from you upfront.

-

It's important to recognise financial difficulty early so you can look at ways to avoid insolvency. You should also be aware of creditors putting enquiries or defaults against your credit file.

You should always seek financial and legal advice when you are having trouble managing your debts. It's difficult to pay for this advice when you're in financial difficulty. However, it's essential for you to know what your options are, and what the consequences are for each option.

Temporary debt protection

While you explore your options, you can apply for temporary debt protection (TDP) from the Australian Financial Security Authority (AFSA). If approved, this will provide you with 21 days temporary protection during which time creditors (including sheriffs) cannot take any enforcement action for the debts you owe.

During this 21-day period, you should seek advice from a lawyer, accountant, insolvency adviser, or start to negotiate payment plans with your creditors.

You cannot reapply for a TDP for a further 12 months, so use the 21-day period wisely to explore the most suitable options for your specific financial situation.

-

Personal insolvency procedures apply to:

- sole traders

- individuals in a partnership.

Before starting a personal insolvency process, it's important to understand the:

- impact of the consequences

- how long the impact will be.

Consequences can include:

- a record on your credit file

- not being able to obtain finance

- having rental applications rejected

- restrictions on future employment

- inability to be a director of a business.

If you're unable to pay your debts, the Bankruptcy Act 1966 (Cwlth) provides 3 formal options for dealing with unmanageable debt.

Debt agreements

Debt agreements, also known as a Part IX agreement, allows you, or the appointed administrator, to negotiate with your creditors to pay a percentage of the combined debts over a period of time to your administrator, rather than trying to continue making payments to each creditor. There are certain thresholds for the value of debt, property and income that you must fall under to be eligible for a Part IX debt agreement.

Personal insolvency agreements

Also known as a Part X agreement, a personal insolvency agreement is a way to come to an agreement with your creditors to settle the debts and avoid bankruptcy. You must have already met the requirements of being assessed as insolvent to be eligible for a Part X agreement. No thresholds for the value of debts, income or property value apply.

Voluntary bankruptcy

Declaring bankruptcy is a serious decision. Bankruptcy will affect your ability to:

- borrow money

- travel overseas

- secure certain employment positions

- become a director of a business or board.

Learn more about bankruptcy.

-

An 'insolvent company' is unable to pay its debts or cover the cost of its overheads. In some situations, insolvent companies may go into liquidation.

Liquidation is when an independent registered liquidator is appointed to take control over the company and wind up the company business in an orderly way. It involves:

- stopping all operations and sales

- selling company assets to pay creditors and staff entitlements

- distributing any surplus funds among shareholders.

There are 3 types of liquidation:

- court liquidation

- creditors' voluntary liquidation

- members' voluntary liquidation.

Learn more about company insolvency procedures.

Use the comparison tool to help you understand and explore which option would best suit your financial situation based on the value of debt, income and property.

Insolvent trading

It is illegal for a business to continue trading and incur debt if it is insolvent. Read more about insolvency and the consequences of insolvent trading.

Send the right message

Conflicting or confusing stories about why you're closing your business can:

- damage your reputation

- destroy goodwill

- make it harder to negotiate with creditors.

To streamline the process and make it as positive and stress-free as possible:

- make sure all stakeholders receive the same, truthful information

- keep your messaging short and factual.

Also consider...

- Read CPA Australia's guide to exiting your business (PDF, 235KB).