Preparing a business quote

A quote is an important tool for your business, particularly if you are selling products or services where each job is different. It tells the customer how much you will charge for the product or service, and what your terms are.

Learn about what you should do before you quote, and find tips and a template for developing quotes.

Value of quotes

Detailed, well-considered quotes win work, however many small business owners find quoting difficult.

| Top reasons for not quoting | Ideas and suggestions |

|---|---|

| It takes too long to prepare the quote | Use a template to easily develop consistent quotes |

| The job is too small or simple | Consider what future opportunities small jobs done well can lead to. A satisfied customer can provide referrals for other customers or return to your business in future |

| You have enough work on | Ask the customer if the job is time critical as they may be prepared to wait for you to become available |

| There's no guarantee that you'll win the job | Prepare a detailed, professional-looking quote that is competitively priced to give you a better chance of customers choosing your business |

Develop a professional quoting process to help your business win work and build a customer database. Good quotes can also help to protect your business from potential risks and losses from errors in legally-binding quotes.

Estimates and quotes

An estimate and a quote are not the same.

An estimate is your rough guide to how much something will cost without having all the specifications or putting time into a quote. Unlike quotes, estimates are not legally binding. An estimate will usually include a disclaimer saying that the price is subject to change.

An estimate is best used when a customer asks you for an indication of the total price. Estimates can indicate the likely cost and scope of a job without committing to prices and terms.

A quote is you agreeing on paper that you have all the information you need to prepare a well-planned and correctly calculated assessment, factoring in all of the specifics necessary to do the work.

If the customer proceeds, then the quote forms part of a legally binding contract between you and the customer. If something goes wrong, and your customer takes legal action, the quote is the key document taken into consideration.

Before you quote

- Understand exactly what your customer wants. Ensure you have enough information to detail the specific scope of works you are quoting on and so your customer has a clear idea of the work you'll do.

- Ensure your business has the skills, experience, resources and availability to meet the customer's requirements.

- Understand, and factor in, the true costs for materials, resources, labour, taxes and proportion of business operational costs.

- Ensure any suppliers can provide the materials in time and at a price that you can markup and still be competitive.

- Conduct market research of your competitors' pricing.

- Make sure you can price the quote competitively and still make a good profit.

- Ask yourself if winning this job would put a strain on your cashflow or resources.

- Consider if this opportunity will provide other benefits to your business (i.e. repeat work, referral opportunities, growth and expansion possibilities, the chance to employ more people).

- Determine the specific terms and conditions you need to factor into the quote.

Supply any supporting documents or marketing materials—flyer, website or capability statement—with the quote to provide a stronger case for your business to win the quote.

Quote template

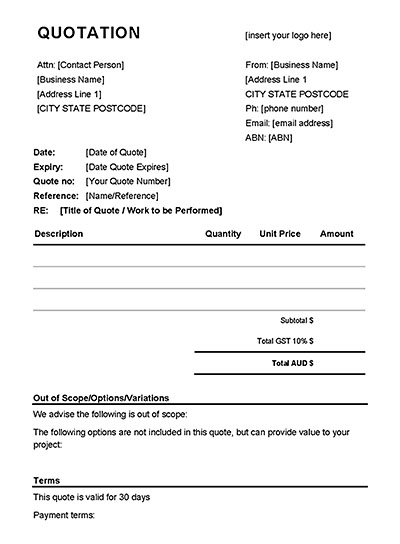

Download the business quote template

The business quote template provides a customisable Word document for you to tailor to your business.

Use this basic template to provide your customers with a description of your work, including quantities and costs and any work that is out of scope.

Download the business quote template.

What to include in your quote

- Business details

Include your legal entity name and trading name, address, Australian business number (ABN), contact details and website. - Quote date, quote number and expiry date

Material costs and supplies can increase quickly. Without an expiry date, you may have to honour a quote that will lose you money. - Costs

Provide a line item breakdown of costs and the total cost. Make sure you show the GST component. Consider adding a buffer into your labour costs in case the work takes longer to complete. - Variations and revisions

List additional accessories or services that are not included in the base level quote. These could be things your customer hasn't considered and could create upselling and value-adding opportunities. - Options

Consider if there are any alternatives or add-ons you wish to include. There may be an opportunity to upsell. - Payment terms and conditions

Indicate what payment methods you accept and when you require payments (e.g. lump-sum, periodical payments, half up-front and half on completion). In some industries, it is common business practice to request half the payment up-front which typically covers most out-of-pocket material costs. This also avoids carrying project costs and assists your cash flow. - Timeline

Offer the expected time for completion or schedule of work—it is important to add a buffer in your expected timeline to cover any issues you may experience, such as staff shortages or supply issues. - Customer acceptance signature line

Include a 'call to action' or prompt to engage the customer to accept your quote and use your business. It can be as simple as a 'sign here' statement, such as 'I, [customer name], accept the above terms and conditions,' with an area to sign and date.

Factors influencing customer decisions

A competitively priced quote is important, but not all customers are price driven.

A customer's decision may also be influenced by:

- your timeline

- your reputation

- the quality of your product or service

- positive reviews and comments on online reviews and your social media

- professionalism and presentation of your quote, marketing material and your website.

10 tips for quoting

-

Ensure you are very clear on your customer's exact requirements, and make sure your customer is equally clear on what you're offering.

Never quote unless you're certain you can deliver to their satisfaction.

Ensure the quoted price is sufficient to get the job done and return a profit.

-

People often forget details of verbal conversations. Written quotes help to ensure everyone is working toward the same goal.

-

Consider:

- typing your quote rather than handwriting it

- using your company's letterhead

- formatting it so it's neatly laid out, well-spaced and structured

- spell checking for grammar and punctuation

- including the customer's name in the greeting and thanking them for the opportunity to quote

- having someone else double-check the quote before you send it to the customer.

-

Consider how you can make your quote and business stand out to help win the customer's business. You might include add-ons or alternative options for their consideration.

Customers may shop around and obtain multiple quotes, but their decision may not always be driven by the cheapest option. Put forward your competitive advantage.

-

Ensure you either have enough stock at the time of quoting, or check with suppliers that they can procure products within the timeframe and budget available.

-

Reach out to your potential customer 7–14 days after submitting your quote.

Ask if they had any questions or have made a decision yet about accepting your quote.

If the customer advises you were not successful, politely ask for some feedback on areas you could improve.

-

Ensure you get either a signature or written confirmation from the customer that they wish to proceed. Do this before you start any work or order materials.

A quote, once accepted by the customer, becomes a legally binding contract.

-

Assess any risks to your business before starting work. This may be resourcing, supplies, staffing, cash flow, reputation, or capacity to do the work.

By assessing these risks upfront, you can implement risk management strategies, advise your client, or withdraw from the job.

-

Customers may need to change the specifications of the job. Always provide a revised quote to ensure your business covers costs and effectively manages your customer's expectations.

-

Make sure you have a detailed understanding of the time you spend on various tasks. This will make it easier to cost jobs for future quotes.

Consider allowing a buffer of time for contingencies.

Consider charging for any additional costs and disbursements at cost plus 15%.

Also consider...

- Read about how to identify your competitive advantage and value proposition.