Financial ratios and calculators

Financial ratios are created by using data from your financial statements to gain information about your business. Analyse the data to assess your business's profitability, liquidity, operating efficiency and leverage.

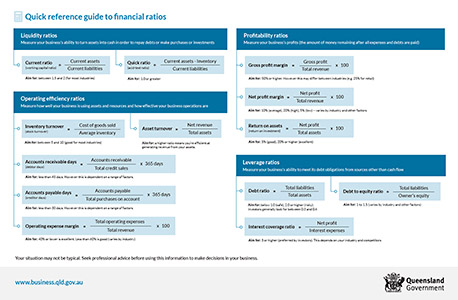

There are a range of ratios you can use – the most important financial ratios are explained in our quick reference guide to financial ratios (JPG, 340KB).

Learn how to calculate ratios using our calculators and read examples to help you apply them to your business.

Talk to your accountant or financial adviser for advice on how to best use ratios in your business. Ratio targets may differ depending on your business situation and industry.

Quick reference guide: financial ratios

Assess the performance of your business by focusing on 4 types of financial ratios:

- profitability ratios

- liquidity ratios

- operating efficiency ratios

- leverage ratios.

Use our quick reference ratios infographic (JPG, 340KB) to understand how to calculate each ratio.

Profitability ratios

These ratios are an effective measure of the amount of money you take home after all of your expenses and debts are paid. They're also a valuable measure of business performance.

Comparing your net and gross profit margins with sector or industry-wide ratios:

- provides relevant benchmarks and figures for comparing against others in your industry, sector or location

- identifies areas for improvement in your margins.

Common profitability ratios

-

Gross profit is the amount of money your business has left over from total revenue once your cost of goods sold has been deducted.

Formula: Gross profit = Total revenue – Cost of goods sold

Calculate gross profit

$$\text{Gross profit} = \text{Total revenue} - \text{Cost of goods sold}$$ -

The gross profit margin ratio compares the gross profit of your business to its total revenue to show how much profit your business is making after paying your cost of goods sold. This ratio shows the percentage margin between what you receive for your product or service and what it costs you in cost of sales. Your gross profit margin shows whether your sales are sufficient to cover your costs of goods sold.

It also allows you to compare your performance with other businesses, or over time, and is a good measure of how efficient your business is at converting products and services into revenue.

Formula: Gross profit margin (%) = (Gross profit ÷ Total revenue) x 100

Aim for: Your figure will depend on your industry or sector. For example, professional services might have 80% or higher, while manufacturing or construction industry might have between 45% and 60%.

Calculate gross profit margin

$$\text{Gross profit margin} = \frac{\text{Gross profit}}{\text{Total revenue}} \times 100$$Gross profit margin ratio example

Brett's Bakery has a total sales revenue of $450,000. After subtracting the $300,000 cost of raw materials (e.g. flour, eggs, sugar) and wages directly involved in baking and selling the goods, the bakery has a gross profit of $150,000. Based on these sales and costs, they have a gross profit margin of 33.33%.

-

The net profit margin ratio compares the net profit of your business to your total revenue to determine operating efficiency.

Your net profit margin is one of the most important indicators of your business's health. It can help you assess:

- if your business is generating enough profit from sales

- if your operating costs and overhead costs are being managed.

Formula: Net profit margin (%) = (Net profit ÷ Total revenue) × 100

Aim for: 10% (average), 20% (high), 5% (low). This varies by industry and other factors.

Calculate net profit margin

$$\text{Net profit margin} = \frac{\text{Net profit}}{\text{Total revenue}} \times 100$$Net profit margin ratio example

Brett's Bakery has a total sales revenue of $450,000. After subtracting their $405,000 total operating expenses, this leaves a net profit of $45,000. Based on these sales and costs, Brett's Bakery has a net profit margin of 10%.

-

The return on assets ratio quantifies how well your business uses its assets to generate profit. This ratio is useful to help assess a business's financial strength and its efficiency in using all available resources.

This ratio provides a valuable business benchmark when compared with other businesses in your sector or industry.

Formula: Return on assets ratio (%) = (Net profit ÷ Total assets) × 100

Aim for: 5% (good), 20% or higher (excellent). This varies by industry.

Calculate return on assets

$$\text{Return on assets} = \frac{\text{Net profit}}{\text{Total assets}} \times 100$$Return on assets ratio example

Brett's Bakery has a net profit of $45,000, and a total value of the business's assets of $600,000 (e.g. cash, stock, equipment, delivery vehicle). This gives an assets ratio of 7.5%.

-

The return on equity ratio measures whether all the effort put into the business is returning an appropriate return on the owner's equity generated.

A sustainable and increasing return on equity over time can mean your business is good at generating value for you. A declining return on equity can mean that you’re making poor decisions on reinvesting capital in unproductive assets.

Formula: Return on equity (%) = Net profit ÷ Owner's equity

This can also be read as: Money invested by the owner of the business + Profits – Money owed – Money taken out of the business by the owner.

Aim for: A high return on equity as this indicates your business can generate cash internally.

Calculate return on equity

$$\text{Return on equity} = \frac{\text{Net profit}}{\text{Owner's equity}} \times 100$$

-

The earnings to sales ratio measures your profits against your sales to make sure you're not spending more than you're making.

You can use this ratio (expressed as a percentage) to measure how well you are containing your expenses. For example, you might set yourself a goal to achieve better than 18%.

Formula: Earnings to sales ratio (%) = (Net profit ÷ Total sales) x 100

Calculate your earnings to sales ratio

$$\text{Earnings to sales ratio} = \frac{\text{Net profit}}{\text{Total sales}} \times 100$$ -

The material to sales ratio indicates how much of your sales dollar is consumed by the cost of direct materials.

Formula: Material to sales ratio (%) = (Cost of direct materials ÷ Sales) x 100

Calculate your materials to sales ratio

$$\text{Materials to sales ratio} = \frac{\text{Cost of direct materials}}{\text{Sales}} \times 100$$Material to sales ratio example

Brett's Bakery has a cost of direct materials of $85,000 and sales of $145,000. This gives a material to sales ratio of 58.6%.

Liquidity ratios

Liquidity ratios measure your business's ability to turn assets into cash to repay debts or make purchases and investments. A higher liquidity ratio means you have more current assets than current liabilities. This indicates you should be able to withstand periods of tight cash flow.

Common liquidity ratios

-

The current ratio, also known as a working capital ratio, measures your business's ability to pay off short-term liabilities (due within a year) with current assets.

Formula: Current ratio = Current assets ÷ Current liabilities

Aim for: Between 1.5 and 2 (for most industries). There is no indication of 'too high' but a very high current ratio may indicate the misuse of excess cash. A current ratio less than 1 can result in reduced opportunities or deregistration if your business is registered under a regulatory body.

Calculate current ratio

$$\text{Current ratio} = \frac{\text{Current assets}}{\text{Current liabilities}}$$Current ratio example

Brett's Bakery has current liabilities of $130,000 (loan repayment of $100,000, credit card bills of $20,000 and supplier bills to pay worth $10,000) and current assets (including cash in the bank and accounts receivable) totalling $260,000. This gives the bakery a current ratio of 2.

-

The quick ratio, also known as an acid-test ratio, measures your business's ability to pay off short-term liabilities with quick assets. It's one of the best measures of liquidity.

When calculating this ratio, only include:

- current assets that are in cash or can be readily converted into cash

- current liabilities that may need to be met quickly.

Formula: Quick ratio = (Current assets – Inventory) ÷ Current liabilities

Aim for: 1.0 or greater (varies by industry) but lower than 10. An acid-test ratio of 10 or above can indicate you have excess cash that you're not using to grow the business, or excessively high debtors.

Calculate quick ratio

$$\text{Quick ratio} = \frac{\text{Current assets} - \text{Inventory}}{\text{Current liabilities}}$$Quick ratio example

Brett's Bakery takes the value of its current assets (cash in the bank and accounts receivable) totalling $260,000, subtracts its inventory value of $10,000 and then divides this total by its current liabilities of $130,000. This generates a quick ratio of 1.92.

Operating efficiency ratios

Operating efficiency ratios, also known as activity financial ratios, measure how well your business is using assets and resources to determine the effectiveness of your operations. These ratios show:

- how quickly stock is being replaced

- frequency of customer debt collection

- frequency of supplier payments.

These calculations provide a benchmark which can help you assess and improve your business's performance.

Benchmarking your operating efficiency ratios with sector businesses will help to identify possible areas for improvement.

Common operating efficiency ratios

-

The accounts receivable days, also known as debtors turnover, measures how often your business can convert debtors into cash over a given period.

Manage your cash flow by trying to collect cash from your debtors before paying your creditors. Aim for your accounts receivable figure to be less than your creditors turnover figure.

Formula: Accounts receivable days = (Accounts receivable ÷ Total credit sales) × 365

Aim for: Less than 40 days (depending on a range of factors). If debtors are too slow in being converted to cash, the liquidity of your business will be severely affected.

Calculate accounts receivable days

Accounts receivable days are sometimes called 'debtor days'.

$$\text{Accounts receivable days} = \frac{\text{Accounts receivable}}{\text{Total credit sales}} \times 365 \text{ days}$$ -

The accounts payable days, also known as creditors turnover, is a measure of how well you are managing creditors over a given period. A lower number of days indicates your business is paying off debts quickly.

Formula: Accounts payable days = (Accounts payable ÷ Total purchase on account) × 365

Aim for: A lower number of days (good, but dependent on a range of factors). A higher number of days (bad) indicates slow payments to suppliers which could damage supplier relationships.

Calculate accounts payable days

Accounts payable days are sometimes called 'creditor days'.

$$\text{Accounts payable days} = \frac{\text{Accounts payable}}{\text{Total purchases on account}} \times 365 \text{ days}$$ -

The stock turnover measures how many times your business's inventory (in dollars) is sold and replaced (stock management) over a given period.

Benchmark your stock turnover ratio against industry averages. A high stock turnover indicates you are selling goods faster. A low turnover rate indicates weak sales and excess inventories.

Your stock turnover will be different depending on your industry or sector. For example, a food business might have a stock turnover of less than 5 (perishables) or manufacturing might have a stock turnover of 40+.

Formulas:

- Stock (inventory) turnover = Cost of goods sold ÷ Average inventory

- Average inventory = (Beginning inventory – Ending inventory) ÷ 2

Aim for: Between 5 and 10 (good for most industries).

Calculate inventory turnover

Inventory turnover is also known as 'stock turnover'.

$$\text{Inventory turnover} = \frac{\text{Cost of goods sold}}{\text{Average inventory}}$$ -

The asset turnover ratio measures your business's ability to generate sales from assets.

Formulas:

- Asset turnover ratio = Net revenue ÷ Total assets

- Net revenue = Total revenue – (Returns + discounts)

Aim for: A high asset turnover, as this indicates you're efficient at generating revenue from your assets. This can vary across industries.

Calculate asset turnover ratio

$$\text{Asset turnover} = \frac{\text{Net revenue}}{\text{Total assets}}$$ -

The error rate ratio will help you evaluate the quality of your production and whether the cost of producing your goods is too high.

A high number may indicate you need to look at your production processes. For example, your goal might be to achieve an error rate of less than 1% (i.e. less than 10 items rejected in 1,000 produced).

Formula: Error rate ratio (%) = (Total items rejected ÷ Total items produced) x 100

Calculate your error rate ratio

$$\text{Error rate ratio} = \frac{\text{Total items rejected}}{\text{Total items produced}} \times 100$$Error rate ratio example

Brett's Bakery produces 20,000 products per month. Out of these, they reject 230 products that get damaged during production. This gives the bakery an error rate ratio of 1.15%.

-

The labour to sales ratio indicates how much of your sales dollar will be spent in direct labour.

Formula: Labour to sales ratio (%) = (Cost of direct labour ÷ Sales) x 100

Calculate your labour to sales ratio

$$\text{Labour to sales ratio} = \frac{\text{Cost of direct labour}}{\text{Sales}} \times 100$$Labour to sales ratio example

Brett's Bakery has a cost of direct labour of $85,000 and records sales of $190,000. This gives the bakery an labour to sales ratio of 44.7%.

-

The operating expense margin indicates how much of the sales dollar will be used for operating expenses, such as rent, gas and electricity.

Formula: Operating expense margin (%) = (Operating expenses ÷ Total revenue) x 100

Operating expense margin example

Brett's Bakery has operating expenses of $20,000 and records a total revenue of $245,000. This gives the bakery an operating expense margin of 8.1%.

Leverage ratios

Leverage ratios indicate your business's ability to meet its debt obligations from sources other than cash flow.

-

The debt ratio measures the proportion of your business's assets that are supported by debt.

Formula: Debt ratio = Total liabilities ÷ Total assets

Aim for: Below 1.0 (safe). 2.0 or higher is risky. Investors generally look for between 0.3 and 0.6.

The debt to asset ratio may be used by your creditors to identify:

- the amount of debt your business is holding

- your ability to repay debts

- whether you'll be awarded additional finance.

Investors use the ratio to assess whether your business is:

- solvent

- able to meet your current and longer-term financial commitments

- able to generate a return on their investment.

If this ratio consistently increases, it can signal an impending default.

Calculate debt ratio

$$\text{Debt ratio} = \frac{\text{Total liabilities}}{\text{Total assets}}$$Debt ratio example

Brett's Bakery has total liabilities of $130,000 (loan repayment of $100,000, credit card bills of $20,000 and supplier bills to pay worth $10,000) and total assets (including cash in the bank, accounts receivable and trademarks) totalling $280,000. This generates a debt ratio of 0.46.

-

The interest coverage ratio, also called the times interest earned ratio, shows how easily your business can pay interest due on any outstanding debts during a given period.

This ratio is commonly used by lenders, creditors and investors to determine the riskiness of lending capital to a business.

Formula: Interest coverage ratio = Net profit ÷ Interest expenses

Aim for: 3 or higher (preferred by investors). This depends on your industry and competitors.

Calculate interest coverage ratio

$$\text{Interest coverage ratio} = \frac{\text{Net profit}}{\text{Interest expenses}}$$Interest coverage ratio example

Brett's Bakery has a net profit of $45,000 and interest expenses of $10,000. This gives an interest coverage ratio of 4.5.

-

The debt to equity ratio calculates the amount of total debt and financial liabilities against owner's equity.

This ratio highlights how your business's capital structure is more supported by either debt or equity financing.

Formula: Debt to equity ratio = Total liabilities ÷ Owner's (shareholder) equity

Aim for: 1 to 1.5 (varies by industry and other factors). Capital-intensive industries (such as manufacturing) often have ratios of 2 or higher.

Calculate debt to equity ratio

$$\text{Debt to equity ratio} = \frac{\text{Total liabilities}}{\text{Owner's equity}}$$Debt to equity ratio example

Brett's Bakery has total liabilities of $130,000 (loan repayment of $100,000, credit card bills of $20,000 and supplier bills to pay worth $10,000) and owner's equity of $675,000 (investment of $400,000 + $450,000 lifetime business profits – $50,000 money owned – $125,000 taken out of the business). This gives a debt to equity ratio of 0.19.