Business crime prevention and premises security

Poor security and criminal events can present a risk to your business. Make sure you consider these risks in advance and put plans in place to help reduce or manage them.

What is business security and crime prevention?

Security and crime prevention are the actions you take to improve the safety and security of your business, and avoid financial loss or disruption to your business.

You also have a duty of care to provide a safe working environment for your staff.

Crime and security threats can include:

- theft (internal and external)

- fraudulent use of online business bank accounts

- false invoicing and payments

- robbery

- shoplifting

- property damage and vandalism

- scams

- cybercrime and attacks (systems hacking, phishing, malware).

Plan for security and crime risks

Security and crime events are often out of your control. Develop and implement systems, plans and policies to:

- reduce the likelihood of some incidents occurring

- reduce the impact and consequences for your business.

Develop a business continuity plan to identify threats to your business, reduce risks and respond and recover during and after incidents.

To help complete your plan, conduct a risk assessment to help identify security risks in your business. Look out for areas where significant potential security threats or criminal opportunities exist.

Using the business continuity plan template:

- record the risk or threat

- consider the impact of the threat to key operations of your business, including losses, costs, staffing, suppliers and scale of impact

- plan how you'll handle the situation, especially if it's likely to need an emergency response.

Having a clear plan will help you and your staff know how to respond during an event, and the steps to take to recover.

Learn more about:

Business continuity plan template

The business continuity plan template will help you develop a:

- risk management plan

- business impact analysis

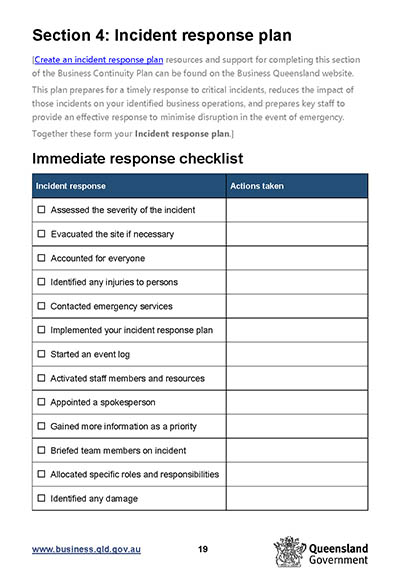

- incident response plan.

Download the business continuity planning template.

Premises security measures

Improve the safety and security of your premises by:

- installing security systems and technology

- introducing deterrents to reduce opportunities for criminal behaviour

- planning for and responding to criminal events.

Consider the following areas when you're preparing your premises to help reduce risk and deter potential criminal activities.

- Consider becoming a cashless business.

- Display signs to show that no cash is kept on the premises.

- Minimise the amount of cash kept in the registers.

- Remove excess cash out of registers regularly.

- Limit cash holdings in safes.

- Change safe access codes regularly.

- Limit access to safes to key staff only.

- Install alarms.

- Install security roller shutters on windows and doors.

- Install security cameras.

- Lock products in cabinets.

- Install security gates.

- Use security tags on products.

- Install anti-virus software on computers.

- Install tracking software on portable computers.

- Change computer passwords regularly.

- Limit staff access to computers and devices.

- Ensure pedestrian entrances and exits are well lit and covered by security cameras.

- Implement policies and procedures for crime prevention.

- Conduct regular staff training and practice drills.

- Train staff in:

- robbery response

- cash handling practices

- identifying suspicious behaviour

- handling difficult customers

- conflict resolution

- workplace health and safety

- crisis and victim support.

- Consider IT threat preparation for small business.

- Develop your cybersecurity.

- Improve your IT risk management.

Safety and preventing crime

The Queensland Police Service (QPS) provide information and programs to help businesses stay safe, address anti-social behaviours and reduce crime.

Read more about business security from the QPS.

Insuring your business

Insurance can help protect your business from loss. Without adequate insurance, your business may face significant financial consequences, affecting your ability to rebuild and recover after a security incident.

Read more about business insurance.

Also consider...

- Learn more about identifying and managing business risk.

- Explore IT threat preparation for small business.

- Find advice on writing a business continuity plan.

- Find out about cybersecurity.

- Find help to prepare an incident response plan.

- Learn more about cybersecurity for business from our Mentoring for Growth mentors.

- Last reviewed: 24 Nov 2022

- Last updated: 21 Sep 2023